Market Analysis and Trends

Bull and Bear Markets in Crypto

Understanding the Cycles of Bull and Bear Markets in the Crypto Space

Market Cycles:

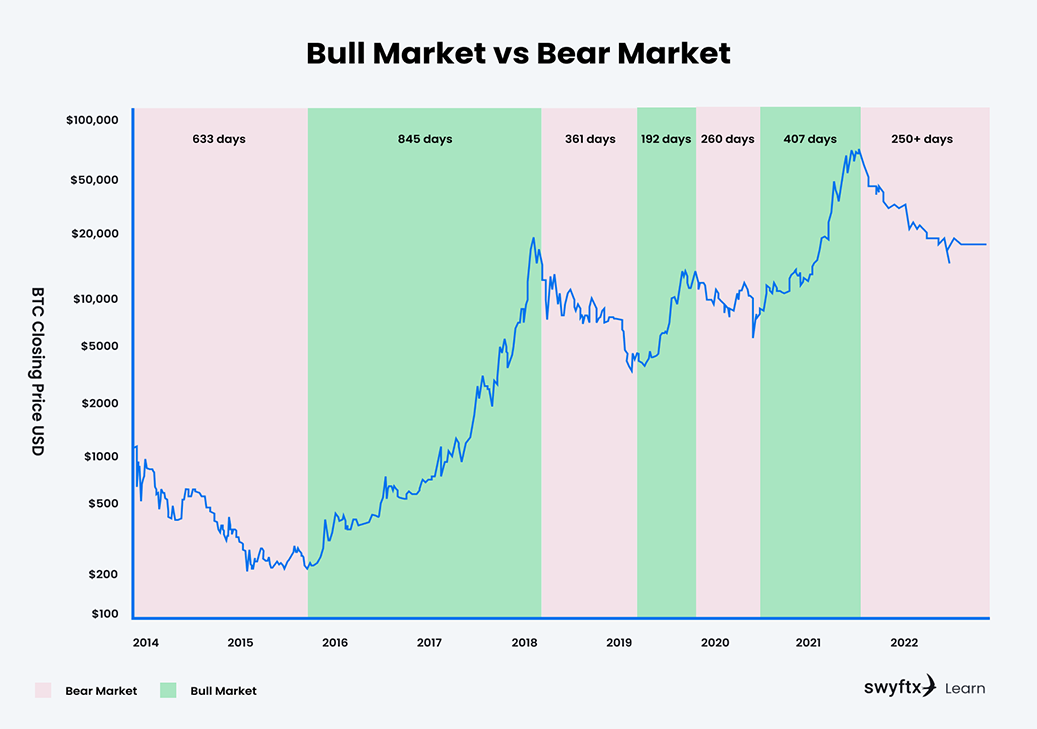

Bull and bear markets are fundamental cycles that characterize the behavior of financial markets, including the crypto space. Understanding these cycles is crucial for investors to make informed decisions.

-

Bull Markets:

- Characteristics: Bull markets are periods of rising prices and optimism among investors. They are driven by strong investor confidence, positive economic indicators, and increasing institutional adoption.

- Factors Driving Bull Markets: During bull markets, demand for cryptocurrencies typically outpaces supply. Positive news events, technological advancements, and favorable regulatory developments can fuel bullish sentiment.

-

Bear Markets:

- Characteristics: Bear markets are characterized by falling prices and pessimism among investors. They are often accompanied by widespread fear, uncertainty, and a decline in trading volumes.

- Factors Leading to Bear Markets: Bear markets can be triggered by negative news events, regulatory uncertainty, economic downturns, or profit-taking after a prolonged bull run. Lack of investor confidence and high volatility are common during bearish phases.

Early Years of Bitcoin:

- 2013 Bull Run: Bitcoin experienced its first major bull market in 2013, driven by increased media coverage and growing adoption.

- 2014 Bear Market: Following the 2013 peak, Bitcoin entered a prolonged bear market, marked by significant price corrections and regulatory challenges.

Bitcoin's Rise to Prominence:

- 2017 Bull Market: Bitcoin and other cryptocurrencies saw explosive growth in late 2017, driven by the ICO boom and speculative trading.

- 2018 Bear Market: The euphoria of 2017 gave way to a bear market in 2018, characterized by sharp price declines and regulatory crackdowns.

Investment Strategies:

Navigating bull and bear markets requires tailored investment strategies to manage risks and maximize returns.

-

Bull Market Strategies:

- Ride the Momentum: In bull markets, investors often capitalize on upward momentum by buying assets with strong fundamentals and growth potential.

- Diversification: Diversifying across different cryptocurrencies and asset classes can mitigate risks and capture opportunities in emerging sectors like DeFi and NFTs.

-

Bear Market Strategies:

- Risk Management: During bear markets, focus on preserving capital and reducing exposure to high-risk assets.

- Value Investing: Identify undervalued cryptocurrencies with strong long-term prospects. Strategic buying during market dips can yield significant returns when the market recovers.

- Staying Informed: Stay updated on market developments, regulatory changes, and technological advancements that could impact market sentiment.

Conclusion:

Understanding the cycles of bull and bear markets is essential for navigating the dynamic and volatile crypto space. By recognizing the characteristics of each market phase and implementing appropriate investment strategies, investors can manage risks effectively and capitalize on opportunities for growth.